If I ask you to name the top three things keeping you up at night as a small business owner, what comes to mind: getting your next customer, funding your next project, work/life balance? One thing you’re probably not thinking about is retirement, and you’re not alone. According to a survey by Manta, about one-third of small business owners don’t have a retirement savings plan. And of those who do, Forbes found that 70% weren’t saving regularly.

Investing for a retirement that is decades away doesn’t seem feasible when you’re also trying to run a business that needs attention now. Maybe you think you’ll sell the company when you get tired of working or perhaps you never plan on retiring. Even if that’s true, you owe it to yourself to have options. Anything can happen, so it’s best to be prepared.

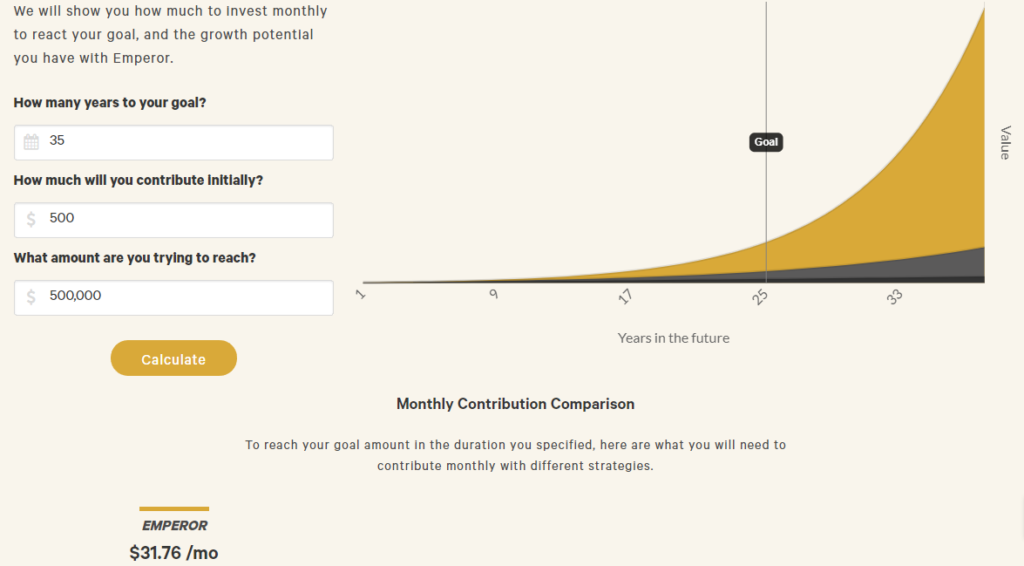

And you don’t need to set aside thousands of dollars to get started. In fact, you can open a retirement savings account with as little as $500.

You’re Ready to Invest. Now What?

Once you decide that it’s time to start saving for retirement, there are a few things you need to.

- Decide on how much you want to invest each month. This is where many entrepreneurs get hung up because their earnings fluctuate. It’s easy to commit to investing $1,500 a month towards retirement if you just made $15,000, but what if you have a slow month? Rather than choosing a set dollar amount, contribute a percentage of your income instead, like 10%. That way, you’ll always be contributing something to your investment account.

- Pick an individual retirement plan (IRA). Two common investment plans are the traditional IRA and the Roth IRA. The one you choose will depend on a number of factors, including how much you want to contribute each year, when you want to be taxed, age limits and distribution penalties. Learn more about the differences between traditional IRAs and Roth IRAs.

- Choose a financial advisor. Many traditional wealth management companies won’t work with you unless you have $250,000 in assets. For an entrepreneur growing a business, that’s not always possible. Enter Emperor Investments, a robo-advisor that helps you create an investment portfolio online with an initial contribution of only $500.

This post is sponsored by Emperor Investments. All opinions are 100% my own, and I only choose to work with companies I believe would benefit Entrepreneur Resources’ readers.

Why Start Your Retirement Savings with Emperor Investments?

It just takes three easy steps to open your account. Complete a quick questionnaire so they can get to know you, your risk tolerance and what to put in your personalized portfolio. Next, review the portfolio they’ve created, and finally, open your account. For retirement-specific goals, choose either a traditional IRA or Roth IRA account.

There’s a low barrier to entry. You only need $500 to open your Emperor Investments account. This is great for entrepreneurs who don’t have the $250,000 in assets wealth management firms require.

Emperor uses pure stock investing with the customer in mind. It uses a mix of active and passive investing to create customized portfolios for its clients. While Emperor’s proprietary technology picks a Dream Team of between 200 and 300 stocks that fit its initial criteria, an analyst then goes in to examine what the numbers don’t show, like whether the company offers a compelling value proposition, strong competitive advantage and a quality management team. It’s the perfect blend of technology and human touch.

You could achieve your goals sooner with dividend reinvesting. While you can never guarantee that a company will continue to pay dividends in the future, Emperor invests in companies that have a very long, unbroken, history of dividend payments. When you earn them, rather than taking a cash payment, opt to reinvest them back into your retirement savings.

Fees are reasonable. While most actively managed accounts charge up to 1% per year, Emperor Investments uses a tiered pricing structure that depends on how much money you have in your account, ranging from 0.60% annually for assets under management of $100,000 or less to as low as 0.20% annually if your account has over $900,001 in it. Sign up here to get started.

Understand how much it takes to reach your retirement goal. There’s a misperception that you must invest thousands of dollars a month to have enough money to comfortably retire. To see if that’s really true, Emperor Investments has a goal calculator that lets you choose an initial investment amount, a goal and a timeframe to achieve it. The calculator will then tell you how much you’d need to contribute to your investment account over time to reach that goal. It may be lower than you think. For example, say you want to retire in 35 years with $500,000 saved. According to the calculator, you’ll only need to invest about $32 per month to stay on track.

These calculators are hypothetical examples used for illustrative purposes and do not represent the performance of any specific investment or product. Rates of return will vary over time, particularly for long-term investments. Investments offering the potential for higher rates of return also involve a higher degree of risk of loss. Actual results will vary.

Even though retirement may be a few decades away, the sooner you start planning the better. That way, you can focus on growing your business now, and let Emperor Investments help make sure you’re well-prepared for your future. Click here to open your account with Emperor Investments today.

Entrepreneur Resources Your source for small business information

Entrepreneur Resources Your source for small business information

Hmm it seems like your blog ate my first comment (it was super long) so I guess I’ll just sum it up what I submitted and say, I’m thoroughly enjoying your blog. I too am an aspiring blog writer but I’m still new to the whole thing. Do you have any tips for first-time blog writers? I’d genuinely appreciate it.